This year, the average annual pay for a landlord in the United States is almost $70,000 per year.

How much you make as a landlord will depend on different factors, like how many properties you own and your rental property locations.

To understand your pay as a landlord, you need to learn about owner statements. Keep reading to discover more.

What Are Owner Statements?

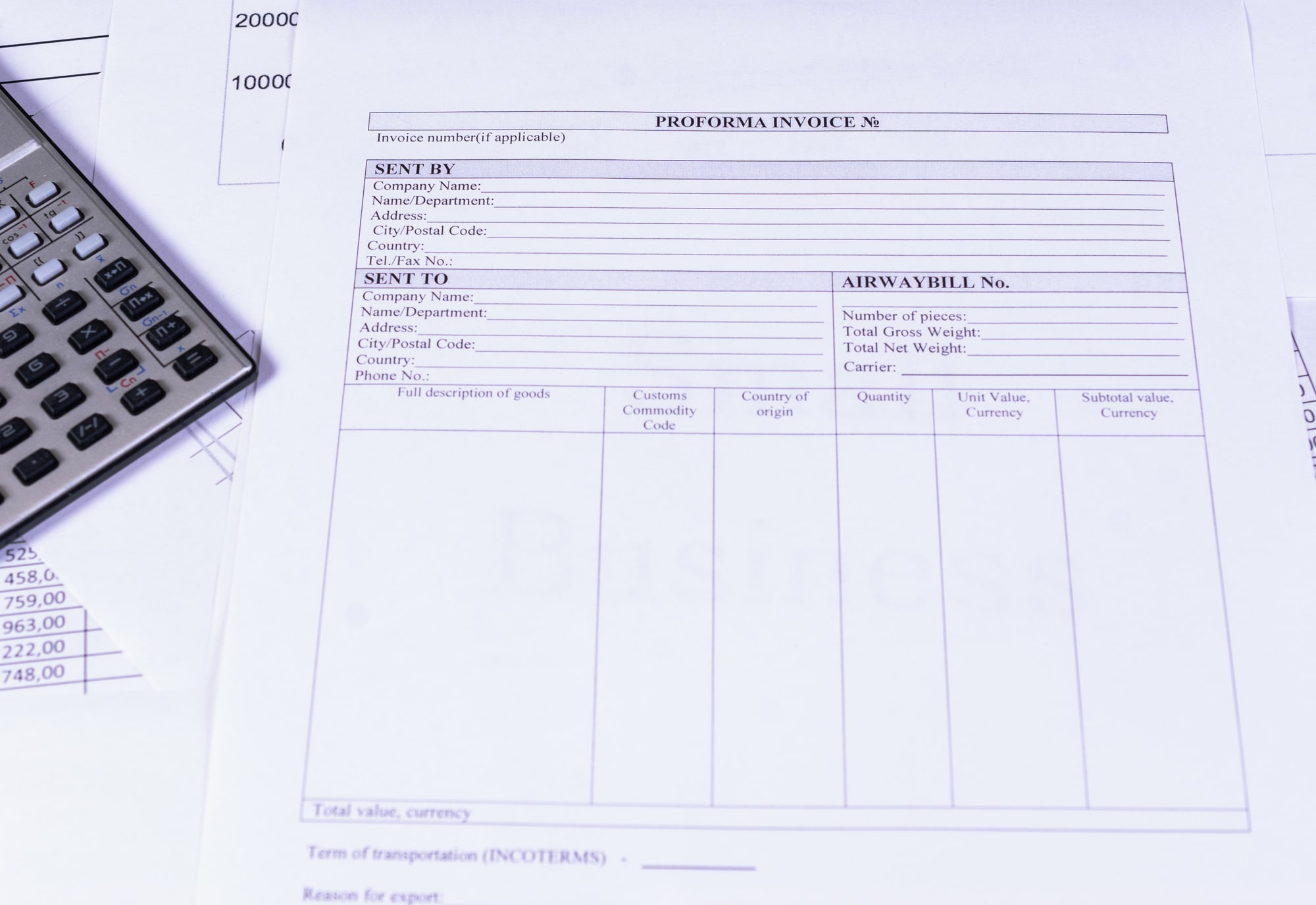

Owner statements are documents providing a detailed account of the financial standings of one or more rental properties.

An owner statement is an essential piece of the accounting side of property management. Each property owner receives a statement once a month for an overview of their rental business.

Owners get a clear picture of what is financially happening on their rental property. This information allows them to budget for the future and makes data-backed decisions about improving the property.

Additionally, owner statements can help during tax season. The IRS might ask to see owner statements to determine how much you own as a rental property owner.

Owner statements can also prove you have tax-deductible expenses.

What's Included in an Owner Statement?

An owner statement provides financial details about a rental property. If you own more than one rental building, you'll receive an owner statement for each property you have.

Owner statements should include the following information:

- Issue Date

- List of all income generated in a given month

- List of all expenses associated with the property in a given month

- Details about outstanding debts owed from or to the property

- Balance of the owner's account at the end of the month

If you have pertinent information like insurance payments made or property taxes paid, these details will be in an owner statement as well.

Owner Statements: The Layout

Owner statements will always have a preparation date, include the owner's name, and detail the contact information of the owner.

To start, the report will have a beginning statement balance. The balance will break down the income and expenses based on the type of property.

Expenses can include anything from maintenance repairs to turnover rates. Each expense entry should include a description of the activities performed and an outline of the costs associated with those activities.

Each building of the rental property will have its own rental income and calculated net total.

Owners can calculate the ending portfolio balance by taking the beginning balance, adding income, and subtracting owner draws and expenses.

Owner draws, aka owner disbursements, are funds that the owner receives during the monthly period. This is essentially how much a property owner gets paid.

How Rental Property Management Can Help

Owner statements aren't easy to draft, especially if you don't know what you are doing. It's time to put the stress of being a rental property owner in the past.

If all you want to worry about is receiving income for your rental properties, hiring rental property management companies can help. We can create owner statements for you, in addition to completing other essential tasks.

Contact us today to learn more about our services.